Solutions for the digital transformation of financial services

With accelerated digital adoption, Open Banking is now actively transforming how businesses and their customers engage and operate. The ability and obligation to provide payment initiation services, and share account data with authorised third parties represents a significant inflection point in the digital transformation of financial services. Amongst many benefits, Open Banking provides greater choice, and quickens and simplifies processes for customers. It also enables automation for quicker decision making, improves responsible lending, and enriches products and services.

The Solution

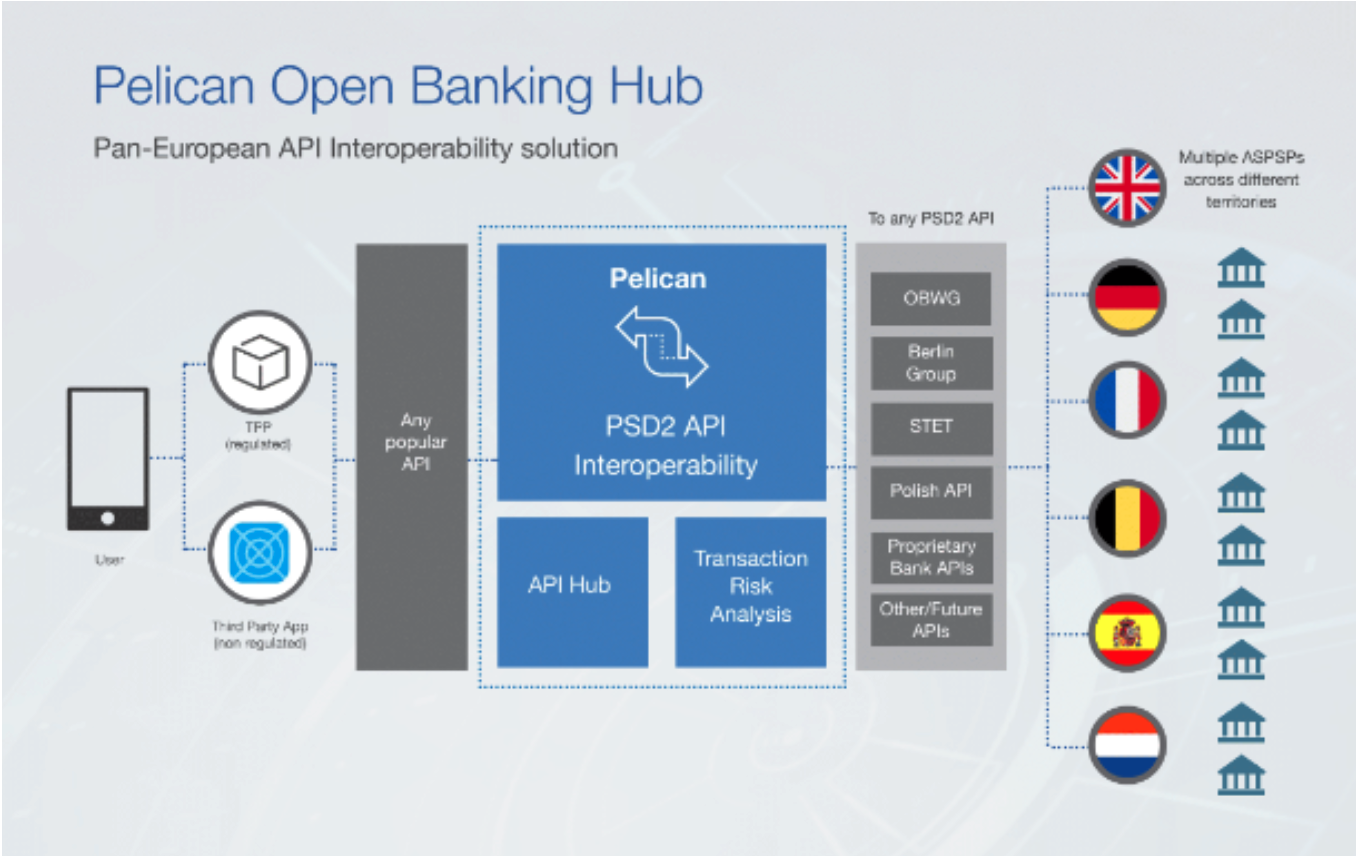

Pelican Open Banking enables banks to take advantage of these growth opportunities. The solution provides full API interoperability (for ease and speed of integration with legacy systems) and AI-based analytics. It allows banks to connect to 4,000+ banks in Europe, with the ability to reach over 400 million potential customers in the pan-European marketplace.

Connect to 4,000 banks in Europe

Powered by just one API feed for ease of integration and real-time information.

Reach over 400 million potential customers

Monetise your data to offer new products and services to the pan-European marketplace.

Accelerate innovation

With our fully integrated AI-powered Open Banking payments solution.

Pan-European Open Banking Solutions

Pelican AI Open Banking Platform

The platform provides all associated services related to payments and account information and has a fully enriched AI powered KYC, fraud, sanctions screening and transaction monitoring capabilities.

Comprehensive service for all your finance / financing needs payment / payment / banking / financial operations needs.

Key Features

- “Solutions” APIs incorporate business domain intricacies within and cover functionalities including: Work flow, Reconciliation, Exception handling, Analytics & Reporting.

- Provides easy to use Open Finance Applications & APIs to Business | Consumers | E-Commerce | Lending & Other financial services.

- One API connecting to 4,000+ banks across Europe using Open Banking + payment infrastructure (e.g. SEPA, Faster Payments).

- AI embedded throughout - categorization, data analytics, insights, AI [ ML & NLP] based: Data Enrichment (incl Cleansing), Analytics & Insights , Recommendations & Optimizations.

- Cloud offering with a superior API technology architecture with ready-to-use SaaS applications reducing our overall TCO to deliver globally supporting multi country multi standards.

Account Information

Regularly retrieve account holder information, balance, and transaction history

Product highlights

- Aggregate accounts - Pelican can connect any of your bank accounts in a few clicks and provides a consolidated overview of all the linked accounts.

- View Global Liquidity and Cash Position - The solution allows customers to view their cash balances across all accounts in different banks, currencies and countries.

Key Features

- Intelligent payment categorisation - Pelican categorises all bank transactions giving a clear expense and income breakdown.

- Forecast cash flow - Pelican predicts your cash flow based on historical data and pending payments. Pelican can advise you when short of funds is expected.

Payment Initiation

Easily offer TPP services, without needing to support multiple APIs

Product highlights

Through a single API standard, customer is able to initiate a payment from the corporate’s bank account. Based on the ASPSPs capabilities, Pelican supports the following payment types:- Single payments / Batch Payments

- Future dated payments

- Merchant payments

Key Features

- Simplify receiving payments - Add a payment link to customer invoices, making it easy for customers to pay and improve your cash flow.

- Simplify wages and tax payments from your accounting system by connecting to bank accounts with few clicks.

- Automate regular payments like payroll or pension, as well as one-off payments.

Solution APIs

“Solution” API Platform enabling Open Finance as a Service

A Platform Approach

- "Solution” APIs incorporate within themselves business domain intricacies covering functionalities such as: Workflows, Reconciliation, Exception handling, Analytics & Report.

- Easy to use Open Finance Applications & APIs for Business, Consumers, E-Commerce, Lenders & Other financial service providers.

- One API connecting to 4,000+ banks across Europe using Open Banking combined with payment infrastructure (e.g. SEPA, Faster Payments).

- AI embedded throughout - ML & NLP based data enrichment (incl cleansing), categorization, analytics & insights , recommendations & optimizations.

- Superior cloud based API platform architecture with ready-to-use SaaS applications.

Key features

- Pelican's vision is to become a cloud native Payments as a Service company that takes the complexity out of running your own domestic or international payment infrastructure by running it for you.

- Solution APIs provide an out of the box Open Finance as a Service platform. The platform has all associated services for payments and account information including an AI powered, fully enriched KYC, fraud, sanctions screening and transaction monitoring capabilities.

- Provide regulatory services for AIS and PIS across Europe and the UK.

- Non-invasive / seamless flow using API / SDKs.

Open Banking Hub Architecture

Find Out More

Built for simplicity and scalability, you can integrate Pelican in as little as four weeks. Reach out and our global team will help you find the right solution for your business.

Related resources & information

Video: Open Banking Hub.

Learn More >Article: Real-time forensics & cognitive automation—How AI is set to transform banking payments.

Learn More >Article: Open Banking demands a customer-centric approach: 3 steps to achieving success.

Learn More >Totally Integrated. Uniquely Powerful.

Pelican’s solutions leverage the unique capabilities of the Pelican Platform.

Each of Pelican's award-winning payments and compliance solutions leverages the advanced capabilities and technologies of the Pelican Platform. These include the Artificial Intelligence disciplines of Machine Learning, Natural Language Processing and Voice processing; Open API integration; rich Omni-Channel UX; flexible Cloud deployment scenarios; and real-time capabilities.

Collectively they provide a uniquely rich technology core, powering the most advanced and capable payments and compliance solutions.