Pelican VOP

A Comprehensive Solution for Secure and Accurate Payment Transactions

Pelican VOP (Verification of Payee) emerges as a cutting-edge solution designed to address the critical concerns of security and accuracy of payment transactions. By verifying the payee's name associated with the account before a transaction is committed, Pelican VOP adds an extra layer of protection against fraud and misdirected payments, safeguarding both financial institutions and their customers. Pelican VOP offers banks the facility to request verification of the payee information from their own banks. Pelican VOP also services incoming VOP requests from other banks by looking up the customer information and performing intelligent name matching and sends back the match results to the requesting banks.

Leveraging Pelican's extensive experience in Open Banking and connectivity to over 2,500 banks across Europe, VOP facilitates seamless integration and interoperability. This broad connectivity ensures that VOP can be easily integrated into the existing banking infrastructure of a wide range of institutions.

The Power of Verification of Payee (VOP)

By ensuring that payments are directed only to the intended recipients, VOP significantly reduces the risk of financial losses due to fraud. It also minimizes the inconvenience and frustration caused by misdirected payments, which can be time-consuming and costly to rectify. In an era where digital transactions are increasingly prevalent, VOP provides a crucial safeguard against the ever-present threat of cybercrime.

Key Features of Pelican VOP

Pelican VOP is not just a verification tool; it's a comprehensive API based solution that offers a range of features designed to enhance the payment experience for both banks and their customers.

Pan-European Reach

|

Pelican VOP acts as an RVM, providing pan-European coverage based on EPC, TIPS, and NPC standards. This ensures that payment requests are routed efficiently and accurately, minimizing delays and errors. Pelican VOP is a versatile solution for banks operating in different countries. This broad reach ensures that VOP can be seamlessly integrated into diverse payment ecosystems. |

Name Matching

|

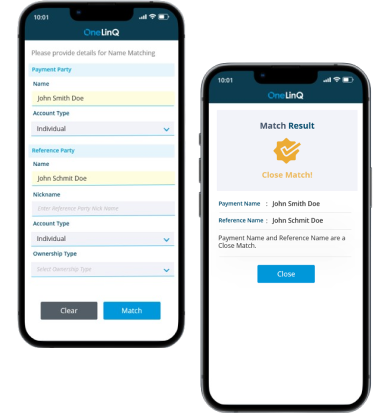

Intelligent Name Matching employing diverse algorithmsVOP's intelligent matching algorithms go beyond simple name comparisons. The system supports the stringent EPC, NPC, and TIPS standards and algorithms as well as others leveraging Pelican's over 20 years of experience for IBAN-Name matching, ensuring accurate verification. This comprehensive algorithms support ensures that the system can adapt to the specific requirements of different payment schemes. |

|

Real-time MatchingThe real-time nature of VOP's matching capabilities means that potential discrepancies are identified instantly, preventing fraudulent and misdirected transactions before they can cause harm. This rapid response is crucial in the fast-paced world of digital finance and instant and irrevocable payments. |

|

Easy IntegrationAlso available as a secure and independent component, it can be easily integrated into existing processes without disrupting operations. This ease of integration minimizes the time and resources required for implementation |

|

Close Match ParametersThe system allows for the configuration of close match parameters through a user-friendly interface, giving banks greater control over the matching process. This fine-grained control enables banks to optimize the system's performance for their specific use cases. |

Configurable Name Matching Algorithms and scoresRecognizing that different institutions have varying risk appetites and requirements, VOP allows for customization of the name matching process. This flexibility ensures that the solution can be tailored to the specific needs of each bank, striking the right balance between security risks and convenience. |

|

Synonym, Alias, and Abbreviation ManagementResponding PSPs can manage synonyms, aliases, and abbreviations to further enhance the accuracy of name matching. This feature is particularly useful for handling variations in names. |

Integration and Compatibility

|

Integration with Banks' SystemsVOP seamlessly integrates with existing banking infrastructure, including back-office systems, CRMs, and ERPs via RESTful APIs. This minimizes disruption to operations and ensures a smooth transition to enhanced payment security. |

|

Compatibility with PSD2VVOP aligns with the Payment Services Directive 2 (PSD2) Account Information Service (AIS), enabling banks to leverage their existing PSD2 AIS offering. |

Deployment

|

Secure and Flexible DeploymentWhether deployed as a fully managed software-as-a-service (SaaS) solution or on-premise, VOP prioritizes data security and compliance. This robust security framework gives banks peace of mind knowing that their data is safeguarded against unauthorized access The deployment flexibility allows banks to choose the deployment model that best suits their infrastructure and security requirements. |

|

High Availability & Disaster RecoveryThe system is designed for high availability and includes robust disaster recovery mechanisms, ensuring uninterrupted service and data integrity. This reliability is crucial for maintaining the smooth flow of payment transactions. |

|

CertificationsPelican VOP's ISO 27001 & ISAE 3402 certifications demonstrate its commitment to security and compliance. These certifications provide independent validation of the system's security measures, giving banks confidence in its ability to protect their data. |

Bulk VOP Requests

|

For institutions dealing with high volumes of transactions, Pelican VOP supports bulk requests, making the verification process more efficient. This feature is particularly valuable for banks that process a large number of payments on a daily basis |

Pelican VOP is not a one-size-fits-all solution. It caters to the specific needs of both requesting and responding banks.

Pelican VOP for Requesting Banks

Pelican VOP is not a one-size-fits-all solution. It caters to the specific needs of both requesting and responding banks.

For requesting banks, Pelican VOP offers a range of features that streamline operations and enhance security

- Pan-European Reach

- Bulk VOP Requests

- Secure and Flexible Deployment

- High Availability & Disaster Recovery

- Compatibility with PSD2

Pelican VOP for Responding Banks

Responding banks also benefit from Pelican VOP's comprehensive suite of features

-

Secure and Flexible Deployment

- Integration with Banks' Systems

- Intelligent Name Matching

- Real-time Matching

- Configurable Name Matching Algorithms

Pelican Intelligent Name Matching

Pelican goes beyond the standard VOP offering with its Intelligent Name Matching component. While included as part Pelican VOP offering, this is also available as an independent component, designed to help Responding Banks meet the stringent name matching standards required by EPC, TIPS, and NPC for the verification of payees.

Key features

- Close Match Parameters

- Synonyms, Alias, and Abbreviation Management

Deployment Options

Like Pelican VOP, the Intelligent Name Matching component offers both fully managed API SaaS and on-premise deployment options. This flexibility allows banks to choose the deployment model that best suits their infrastructure and security requirements.

Pelican VoP Architecture

Key Components

|

Pelican VOP API: This is the core interface through which requesting banks interact with the VOP service. It enables them to send verification requests and receive responses in real time.

|

|

|

VOP Routing & Verification Mechanism (RVM) Engine: This component acts as a central hub, routing VOP requests from requesting banks to the appropriate responding banks. It ensures that requests are directed to the correct banks for verification.

|

|

|

VOP API Name Match: This module services the incoming VOP requests and plays a crucial role in verifying the payee's name associated with the account. It employs intelligent algorithms to compare and match names, even in cases of variations, misspellings, or abbreviations.

|

|

Pelican Cloud: The entire VOP solution is hosted on a secure cloud platform, ensuring dataprivacy, protection, and high availability.

|

|

Interoperability: The diagram highlights the system's interoperability with other RVM providers, such as EBA Clearing, COP, and others by adhering to EPC, TIPS and NPC scheme rules. This allows for seamless integration with various payment systems and networks

|

Flow of Information – Initiating VOP Request

|

The requesting bank initiates a payment transaction and sends a VOP request through the Pelican VOP API. |

|

The RVM Engine receives the request and routes it to the appropriate responding bank based on the beneficiary's account details. |

|

The responding bank sends a VOP response back to the RVM, indicating whether the beneficiary's information is valid. |

|

The RVM Engine receives the response from the responding bank, allowing requesting bank to proceed with the payment if the verification is successful. |

Flow of Information – Responding to VOP Request

|

Pelican VOP receives inbound request from requesting bank through the RVM |

|

Pelican VOP API Name Match module verifies the beneficiary's information received in the request by looking up and comparing with the information on record at the responding bank using intelligent name matching algorithms configured for the bank and arrives at the response. |

|

Pelican VOP sends the VOP response back to the RVM, indicating whether the beneficiary's information is valid. |

|

The RVM relays the response to the requesting bank, allowing them to proceed with the payment if the verification is successful. |

Find Out More Pelican VOP

Built for simplicity and scalability, you can integrate Pelican in as little as four weeks. Reach out and our global team will help you find the right solution for your business.

Related resources & information

Press Release: Pelican launches Verification of Payee Service, a cutting-edge solution for secure and accurate payment transactions.

Learn More >